Introduction to Contract Electronics Manufacturing

A contract electronics manufacturer (CEM) is a company that manufactures electronic components, subassemblies, products, and systems for other companies based on their designs and specifications. CEMs are also sometimes referred to as electronic manufacturing services (EMS) providers.

The CEM industry emerged in the 1970s as original equipment manufacturers (OEMs) began outsourcing manufacturing to focus on their core competencies like design, marketing, and branding. CEMs offer OEMs a way to optimize their supply chains, reduce costs, and improve time-to-market.

Some key facts about the CEM industry:

- Global CEM/EMS market size estimated at over $500 billion in 2022

- Top 5 CEMs (Foxconn, Flex, Jabil, Sanmina, Celestica) have combined revenue of over $150 billion

- CEMs manufacture products in a wide range of industries like consumer electronics, automotive, aerospace, medical devices, industrial equipment

- Main end-market segments are computing/servers, networking/telecom, mobile phones, consumer appliances, automotive electronics

- Most manufacturing is concentrated in Asia (China, Taiwan, Southeast Asia) due to labor costs and supply chain clusters

Services Offered by Contract Electronics Manufacturers

CEMs offer end-to-end manufacturing services that allow OEMs to outsource their entire production process. The range of services includes:

Design Support

- Design for manufacturing (DFM) – Providing feedback on product designs to optimize them for manufacturability

- Component engineering – Help selecting optimal components and suppliers

- Testing and validation – Simulate manufacturing processes and performance to validate designs

- Prototyping – Produce prototypes and first articles to test products

Supply Chain Management

- Sourcing components and raw materials globally

- Managing suppliers and procurement

- Inventory management, warehousing, and logistics

Manufacturing

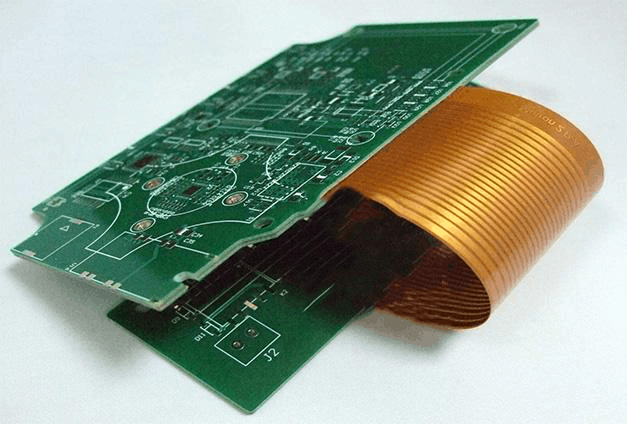

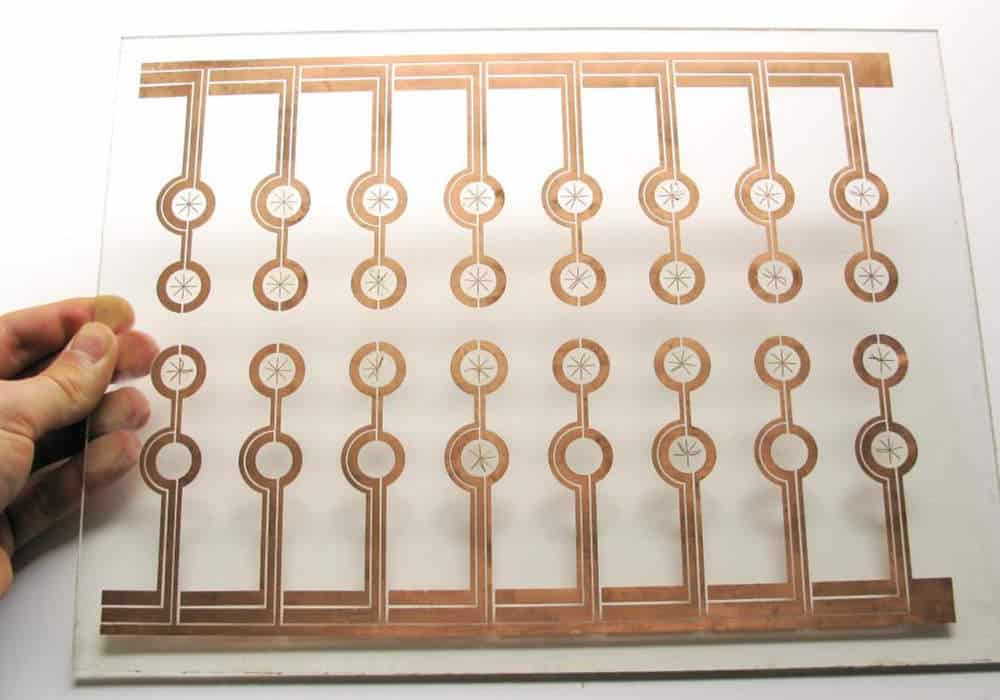

- PCB assembly – Populating printed circuit boards (SMT, thru-hole, testing, inspection)

- Box build – Assembling sub-assemblies into final enclosures

- System integration and rack integration

- Complex/high mix manufacturing

- Automated assembly and test

- Model, product, and process validation

Post-Manufacturing Support

- Order fulfillment, configure-to-order, and direct order fulfillment for customers

- Repairs, refurbishment, maintenance

- Managing product lifecycle and obsolescence

- Aftermarket services like spare parts

CEMs provide all the manufacturing infrastructure, processes, and labor needed so OEMs don’t have to invest in factories and equipment. This frees up OEMs to focus on innovation in their core product lines.

Benefits of Using a Contract Manufacturer

There are many potential benefits for OEMs in partnering with a CEM:

Cost Savings

- Economies of scale from aggregated volumes and purchasing power

- Lower component costs by leveraging CEM relationships

- Savings from consolidating to fewer manufacturing locations

- Avoid capital investment in facilities/equipment

- Convert fixed costs to variable, pay only for services needed

Faster Time-to-Market

- CEMs have proven processes and infrastructure ready to deploy

- Parallel workstreams for design and manufacturing

- Faster ramp up of new product introductions

- Expertise to resolve design and process issues quickly

Supply Chain Excellence

- CEMs relationships with thousands of suppliers globally

- Strategic sourcing to find optimal suppliers

- Consolidated procurement lowers costs

- Supply continuity through managed inventories

Manufacturing Flexibility

- Ability to scale capacity up or down as needed

- Shift production between locations as needed

- Meet spikes in demand more easily

- Mix high and low volume production optimally

Quality and Reliability

- Mature quality systems and process controls

- Automated inspection, testing, validation

- Continuous improvement and lean expertise

- Data analysis and reporting for root cause analysis

Focus on Innovation

- Free up resources to invest in new technologies

- Internal product teams can focus on design, features, user experience

- Faster time from development to production

How Contract Manufacturing Works

Partnering with a CEM involves close collaboration in all stages of the product lifecycle:

Product Development

- OEM engages CEM early for design input

- CEM reviews designs for manufacturability and cost optimization

- CEM builds prototypes and first articles for validation

Product Ramp Up

- Processes qualified and validated before production starts

- Initial orders produced to verify quality

- Ramp plans coordinated between OEM and CEM

Volume Production

- CEM ensures component availability meets demand forecasts

- Capacity levels flexed based on order volumes

- Ongoing process audits and quality monitoring

Product Transition

- Manage product change notifications and end-of-life components

- Coordinated last time buys and inventory of discontinued parts

- Transition to next generation products or replacements

Throughout these phases, OEMs and CEM account teams collaborate closely through meetings, design reviews, production monitoring, and data sharing. The goal is full transparency between partners.

How OEMs Select a Contract Manufacturer

Choosing the right CEM is critical in determining the success of a manufacturing engagement. OEMs evaluate CEMs on several criteria:

Industry Experience

- Expertise and track record in the OEM’s target markets

- Experience manufacturing similar products and technologies

- Understanding of applicable standards and regulations

Services and Capabilities

- Range of services offered (design, supply chain, manufacturing, post-manufacturing)

- Manufacturing technologies and automation capabilities

- Testing, validation, and quality management expertise

Facilities and Capacity

- Locations match target regional markets

- Infrastructure meets projected capacity and mix needs

- Scalability to meet demand fluctuations

Component Sourcing

- Procurement leverage based on spend volumes

- Established network of approved suppliers

- Systems for managing inventory and obsolescence

Culture and Communication

- Collaborative problem-solving approach

- Clear reporting and visibility into operations

- Proactive communications and program management

Cost Competitiveness

- Total cost models factoring overhead, labor, logistics

- Economies of scale from aggregated volumes

- Value engineering expertise to optimize costs

OEMs typically create a shortlist of CEMs and request proposals including pricing, timelines, deliverables, and key performance indicators to measure success. CEM selection decisions have long-term impacts, so thorough due diligence is important.

Challenges Working with Contract Manufacturers

While outsourcing manufacturing has significant advantages, OEMs should also be aware of potential risks and downsides:

Loss of Control

- OEM has less control and visibility into manufacturing ops

- Must rely on CEM for quality, capacity management, continuity planning

Design Protection

- Possibility of IP leakage to competitors who use the same CEM

Supplier Relationships

- CEM manages component sourcing rather than OEM

- Reduces OEM’s leverage and relationships with suppliers

Hidden Costs

- Total cost not always transparent (e.g. expedite fees, MOQ charges)

- Cost reduction incentives may not be aligned

Inflexibility

- Contracts may limit ability to change volumes or manufacturing locations

- Requires advanced notice and signoff for product/process changes

Obsolescence Risk

- Liability for unused inventory may reside with OEM

- CEM may not manage last time buys optimally

To mitigate these risks, OEMs should have clear contracts, maintain involvement in supplier selection, audit CEM processes, and develop contingency plans. Both parties must be open in communications and set expectations upfront.

Major Global Contract Manufacturers

The CEM industry is dominated by a handful of large global players with billions in revenue:

Foxconn

The world’s largest contract manufacturer with $200+ billion in annual revenue. Headquartered in Taiwan with factories across China. They produce electronics for major brands like Apple, Sony, Microsoft, HP, Amazon, Tesla, and more.

Flex

Provides design, manufacturing, and supply chain services for various industries. Headquartered in Singapore with $25+ billion in revenue and 200,000 employees worldwide.

Jabil

A U.S.-based CEM with over $29 billion in revenue and 200,000 employees. They manufacturer electronic products and components for a wide range of markets.

Sanmina

A leading CEM based in the U.S. with $6.5 billion in revenue. They provide manufacturing solutions for OEMs in industries like communications, computing, medical, defense, automotive, and industrial.

Celestica

A Canadian CEM with over $5.5 billion in revenue and operations across the Americas, Europe, and Asia. They partner with companies in aerospace, industrial, healthtech, enterprise and communications markets.

There are also thousands of smaller CEMs operating regionally or focused on specific industries like aerospace, medical devices, industrial equipment, etc. While the large CEMs work with bigger brands, smaller CEMs cater to startups and mid-sized companies.

The Future of Contract Manufacturing

The CEM/EMS industry will continue evolving to meet the changing needs of OEMs:

Geographic shifts – Manufacturing may shift from China to regions like Southeast Asia and India for supply chain resilience. Nearshoring to Mexico, Central America could also accelerate for North American markets.

Technology adoption – CEMs will invest more in automation like robotics, 3D printing, computer vision for quality control, and data analytics for “smart factory” concepts. These can improve productivity, quality consistency and traceability.

Sustainability – CEMs will help OEMs meet environmental goals by reducing waste, energy use, emissions and adopting greener chemistries. Circular economy practices around repair, reuse and recycling will grow.

Aftermarket services – Providing services post-production like repairs, spare parts, upgrades and refurbishment will be a bigger part of CEM offerings. This extends engagement over product lifecycles.

Expansion into new sectors – CEM capabilities will expand into new product categories like medical devices, electric vehicles, batteries, and clean tech products.

As electronics become essential across more industries, OEMs will likely outsource more manufacturing. CEMs in turn will evolve into strategic innovation partners that enable ideas to reach global markets efficiently.

Frequently Asked Questions

Here are answers to some common questions about contract electronics manufacturing:

Q: What types of products do CEMs manufacture?

CEMs produce a vast range of electronic products and components – anything from circuit boards, sensors, and wire harnesses to controllers, server racks, computers, appliances, and various assemblies. Essentially any product with electronic content can be outsourced to a CEM.

Q: Do CEMs only manufacture electronics?

While electronics is their primary focus, some CEMs have capabilities for related manufacturing like precision metals fabrication, plastics injection molding, electromechanical subassemblies, and testing processes. So CEMs can provide complementary services beyond electronics in some cases.

Q: Can a startup work with a CEM?

Absolutely. While CEMs are known for serving large OEMs, they work with companies of all sizes. Startups represent an emerging segment as they often lack experience and infrastructure for manufacturing. CEMs can provide startups a faster, lower-risk path to production.

Q: Where are most CEM facilities located?

The majority of large CEM manufacturing happens in Asia – China, Taiwan, and Southeast Asia in particular. This allows access to the skilled labor, component suppliers, and economies of scale the region offers. However CEMs also have operations closer to target consumer markets for faster delivery and localization.

Q: How are CEMs and ODMs different?

Original design manufacturers (ODMs) design and develop products that they then manufacture – “original” refers to owning the designs. CEMs strictly manufacture products designed by their customers. ODMs assume more upfront development investment whereas CEMs focus on optimized manufacturing.

Q: Can OEMs easily switch between CEMs?

Switching CEMs once production is underway can be challenging due to specialized tooling, processes, and supplier ecosystem created for that product. However CEMs should provide termination assistance to help transition production elsewhere. Having secondary CEM sources in parallel provides a backup option.

Leave a Reply