What is the PCB Book-to-Bill Ratio?

The book-to-bill ratio measures the health of the PCB market by comparing orders booked to orders shipped and billed over a specific time period, typically monthly. A ratio above 1.0 indicates more orders were received than filled, pointing to strengthening demand. Conversely, a ratio below 1.0 suggests weaker demand as orders slow.

IPC’s monthly PCB book-to-bill is based on data provided by member companies representing an estimated 90% of the U.S. PCB market.

PCB Book-to-Bill Hits 1.29 in February

For February 2023, the PCB book-to-bill came in at a robust 1.29, up from 1.21 in January and the highest reading since April 2020 near the start of the COVID-19 pandemic. The 1.29 figure means that for every $100 of orders shipped, $129 of new orders were received.

“The book-to-bill ratio jumped in February, indicating strong demand as electronics manufacturers ramp up production and replenish inventories,” said Shawn DuBravac, IPC’s chief economist. “Backlogs are growing longer and capacity utilization is ticking higher.”

PCB Orders and Sales Trending Upward

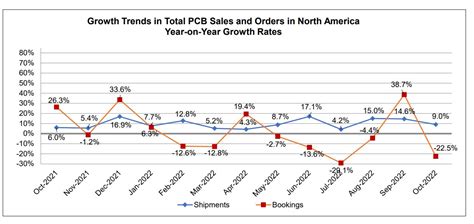

Delving deeper into the data:

- PCB orders in February were up 27.2% compared to January and 8.7% higher than February 2022.

- Shipments increased 18.1% versus the prior month and rose 3.6% year-over-year.

- Year-to-date orders are running 6.2% above the same period in 2022, while shipments have increased 2.1%.

| Month | Book-to-Bill Ratio | Orders (% change vs. prior month) | Orders (% change vs. prior year) | Shipments (% change vs. prior month) | Shipments (% change vs. prior year) |

|---|---|---|---|---|---|

| Jan ’23 | 1.21 | -5.6% | +11.8% | +2.2% | +6.4% |

| Feb ’23 | 1.29 | +27.2% | +8.7% | +18.1% | +3.6% |

The book-to-bill ratios and order/shipment changes reflect both the normal seasonality coming out of the slower holiday period as well as strengthening underlying demand for PCBs across key end markets like automotive, industrial, medical, and aerospace & defense.

Recovery Broadening Across PCB Product Mix

IPC notes that the recovery in the North American PCB market that began in late 2022 has broadened from mainly defense and medical sectors to other commercial markets in recent months. High-volume products like HDI, rigid-flex, and multilayer boards are seeing an uptick along with lower-volume, higher-mix designs.

“It’s encouraging to see the pickup in demand extending across the product spectrum,” adds DuBravac. “The book-to-bill remaining above parity for four straight months now suggests the positive momentum has legs.”

Positive Outlook But Risks Remain

Looking ahead, IPC expects the strong trajectory in PCB orders to continue in the near-term based on customer forecasts and broader economic tailwinds. However, potential headwinds like supply chain constraints, inflationary pressures, geopolitical tensions, and the possibility of a recession remain risks to the outlook.

“While we’re optimistic given the current demand signals, we’re also closely monitoring the macro environment for any signs of softening,” notes DuBravac. “The PCB industry has proven resilient but isn’t immune to broader economic crosscurrents.”

For now though, the jump in the book-to-bill to a nearly three-year high is an auspicious sign for the PCB market as it moves through 2023, especially compared to pandemic lows. As a key leading indicator, it points to an industry on increasingly stable footing.

Frequently Asked Questions (FAQ)

1. What is a good book-to-bill ratio?

A book-to-bill ratio above 1.0 is generally considered healthy, indicating more orders are being received than shipped. The higher above 1.0, the stronger the sign of growth. Ratios below 1.0 point to weaker demand.

2. How often is the PCB book-to-bill reported?

IPC releases its PCB book-to-bill report monthly, typically in the last week of the following month. The report covers the prior month and includes comparisons to the preceding month and year.

3. What is included in PCB orders?

PCB orders represent the value of new orders received from customers during the month across the spectrum of PCB products like rigid, flexible, HDI, and IC substrates. Orders are typically based on customer forecasts and subject to change.

4. How long has IPC been tracking the PCB book-to-bill?

IPC has reported its PCB book-to-bill ratio monthly since January 1991, giving the industry over three decades of data to analyze cyclical trends and turning points in the market.

5. Are there any limitations to the PCB book-to-bill?

While the book-to-bill is a valuable leading indicator of industry health and trajectory, it is nonetheless one data point that should be assessed in context with other economic and market factors. Rapid changes in orders in either direction may not immediately translate to comparable changes in shipments. The ratio also only covers the North American market directly.

Leave a Reply