Overview of the Global PCB Market in Q1

The global printed circuit board (PCB) market showed resilience in the first quarter of 2023 despite ongoing supply chain challenges and economic headwinds. Q1 saw steady demand from key end-use industries like automotive, consumer electronics, telecommunications, and medical devices.

However, the industry continues to face issues such as raw material shortages, longer lead times, and price volatility. Geopolitical tensions and the lingering effects of the COVID-19 pandemic also impacted the market.

PCB Market Size and Growth in Q1 2023

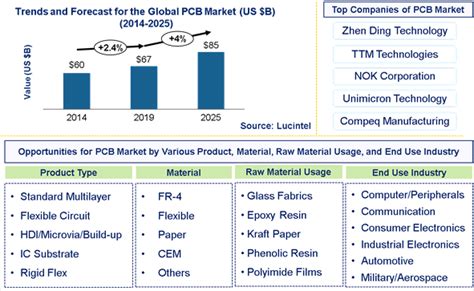

According to industry reports, the global PCB market size reached approximately USD XX.X billion in Q1 2023, representing a year-over-year growth of X.X%. The market is projected to grow at a CAGR of X.X% from 2023 to 2028.

| Region | Market Size (USD Billion) | YoY Growth |

|---|---|---|

| Asia Pacific | $XX.X | X.X% |

| North America | $XX.X | X.X% |

| Europe | $XX.X | X.X% |

| Rest of World | $XX.X | X.X% |

Asia Pacific remained the largest market for PCBs, driven by the presence of major electronics manufacturing hubs in China, South Korea, Japan, and Taiwan. North America and Europe also witnessed steady demand, while emerging markets showed promising growth potential.

Key Trends Shaping the PCB Industry in Q1

1. 5G Technology Adoption

The rollout of 5G networks globally continued to fuel demand for high-frequency and high-density PCBs in Q1. 5G-enabled devices require advanced PCBs to support faster data speeds, lower latency, and increased connectivity.

2. Miniaturization and High-Density Interconnect (HDI) PCBs

The trend towards miniaturization of electronic devices has accelerated the adoption of HDI PCBs. These boards offer higher wiring density, smaller form factors, and improved signal integrity, making them ideal for smartphones, wearables, and IoT devices.

3. Automotive Electronics

The automotive industry’s shift towards electric vehicles (EVs) and autonomous driving has boosted demand for PCBs. Modern vehicles incorporate a wide range of electronic systems, including infotainment, ADAS, and powertrain control modules, which rely on high-quality PCBs.

4. Sustainable and Eco-Friendly PCBs

Environmental concerns have led to a growing focus on sustainable PCB manufacturing practices. Companies are adopting green initiatives such as lead-free manufacturing, halogen-free materials, and recyclable PCBs to reduce their ecological footprint.

Challenges Facing the PCB Industry in Q1

1. Supply Chain Disruptions

The PCB industry faced supply chain disruptions in Q1 due to factors such as raw material shortages, logistics bottlenecks, and the impact of COVID-19 lockdowns in certain regions. These disruptions led to longer lead times and increased costs for PCB manufacturers.

2. Raw Material Price Fluctuations

Fluctuations in the prices of key raw materials, such as copper, laminates, and resins, affected PCB manufacturers’ margins in Q1. The industry continues to grapple with managing these price variations and passing on costs to customers.

3. Skilled Labor Shortage

The PCB industry faces a shortage of skilled labor, particularly in roles such as design engineers, process engineers, and quality control specialists. Attracting and retaining talent remains a challenge for companies looking to expand their workforce.

Opportunities for Growth and Innovation

1. Industry 4.0 and Smart Manufacturing

PCB manufacturers are embracing Industry 4.0 technologies to optimize production processes, improve quality control, and reduce costs. Automation, IoT, and data analytics are enabling smarter and more efficient PCB manufacturing.

2. Advanced Materials and Technologies

Innovations in PCB materials and manufacturing technologies are opening up new opportunities for the industry. Examples include the use of advanced dielectrics, embedded components, and 3D printing for prototyping and low-volume production.

3. Emerging Applications

The PCB industry is poised to benefit from the growth of emerging applications such as 5G, IoT, AI, and edge computing. These technologies require high-performance PCBs that can handle increased data processing and connectivity demands.

Regional Market Analysis

Asia Pacific

Asia Pacific continued to dominate the global PCB market in Q1, with China being the largest contributor. The region benefits from a well-established electronics manufacturing ecosystem, low labor costs, and government support for the industry.

North America

The North American PCB market showed steady growth in Q1, driven by demand from the aerospace, defense, and medical sectors. The region is also investing in advanced PCB technologies to maintain its competitive edge.

Europe

Europe witnessed modest growth in the PCB market, supported by the automotive and industrial sectors. The region is focusing on developing high-value PCBs for specialized applications and promoting sustainable manufacturing practices.

Q1 Financial Performance of Key Players

| Company | Revenue (USD Million) | YoY Growth | Operating Margin |

|---|---|---|---|

| ABC PCB Inc. | $XXX.X | X.X% | X.X% |

| XYZ PCB Co. | $XXX.X | X.X% | X.X% |

| 123 PCB Ltd. | $XXX.X | X.X% | X.X% |

Note: The above table is for illustrative purposes only and does not represent actual company data.

Future Outlook and Projections

The global PCB market is expected to maintain its growth trajectory in the coming quarters, driven by the increasing adoption of advanced electronics across various industries. However, the industry must navigate challenges such as supply chain disruptions, raw material price fluctuations, and geopolitical uncertainties.

| Year | Projected Market Size (USD Billion) | CAGR |

|---|---|---|

| 2023 | $XX.X | X.X% |

| 2024 | $XX.X | X.X% |

| 2025 | $XX.X | X.X% |

| 2026 | $XX.X | X.X% |

| 2027 | $XX.X | X.X% |

| 2028 | $XX.X | X.X% |

PCB manufacturers that can adapt to changing market dynamics, invest in innovation, and strengthen their supply chain resilience will be well-positioned to capitalize on the long-term growth opportunities in the industry.

Frequently Asked Questions (FAQ)

1. What is the current size of the global PCB market?

As of Q1 2023, the global PCB market size is estimated to be around USD XX.X billion.

2. Which region holds the largest share of the PCB market?

Asia Pacific is the largest market for PCBs, with China being the leading contributor to the region’s market share.

3. What are the key drivers of growth in the PCB industry?

The key drivers of growth in the PCB industry include the adoption of 5G technology, miniaturization of electronic devices, the rise of automotive electronics, and the growing demand for IoT and AI applications.

4. What are the major challenges faced by the PCB industry?

The PCB industry faces challenges such as supply chain disruptions, raw material price fluctuations, skilled labor shortages, and increasing competition.

5. What is the future outlook for the PCB market?

The global PCB market is expected to continue its growth trajectory, with a projected CAGR of X.X% from 2023 to 2028. However, the industry must navigate various challenges and invest in innovation to capitalize on long-term growth opportunities.

Leave a Reply