What is a Freight Collect Account?

A freight collect account, also known as a “bill to” or “third party billing” account, is an arrangement where the shipper’s transportation charges are billed directly to a separate account with the carrier instead of being paid upfront by the shipper. The account holder, which may be the shipper, receiver, or a third party, is responsible for paying the accrued freight charges according to the payment terms established with the carrier.

Benefits of Using a Freight Collect Account

There are several key advantages to using a freight collect account for your shipping needs:

-

Simplified billing and payment – Charges are consolidated into a single invoice, usually on a weekly or monthly basis, making it easier to review and pay shipping costs.

-

Improved cash flow – Shippers do not have to pay for freight at the time of shipping, freeing up working capital.

-

Reduced administrative overhead – Automating the billing process eliminates the need to manually process individual freight invoices.

-

Enhanced visibility – Detailed reporting provides insights into shipping patterns, costs, and opportunities for optimization.

-

Potential discounts – High-volume shippers may be able to negotiate reduced rates by leveraging their freight spend.

Setting Up Your Freight Collect Account

To get started, you’ll need to choose a carrier and apply for a freight collect account. The setup process typically involves the following steps:

-

Select a carrier – Research and compare carriers to find one that best meets your shipping needs and provides the desired level of service and coverage. Consider factors such as rates, transit times, reliability, and technology capabilities.

-

Submit an application – Contact the carrier’s sales or customer service department to request a freight collect account application. You will need to provide information about your company, shipping volumes, and credit references.

-

Undergo a credit review – The carrier will assess your creditworthiness to determine eligibility and establish credit terms. This may involve submitting financial statements or other documentation.

-

Sign an agreement – Once approved, you’ll enter into a formal agreement with the carrier outlining rates, payment terms, liability limits, and any other applicable terms and conditions.

-

Receive account credentials – The carrier will provide you with an account number and any necessary login information to access their online billing and reporting tools.

Required Information for Account Setup

When applying for a freight collect account, be prepared to provide the following information:

- Company name and contact details

- Shipping locations and volume estimates

- Credit references and financial statements

- Preferred payment method (e.g. check, ACH, credit card)

- Authorized users and access levels

Using Your Freight Collect Account

Once your freight collect account is set up, you can start using it to manage and pay for your shipments. Here’s a step-by-step overview of the process:

-

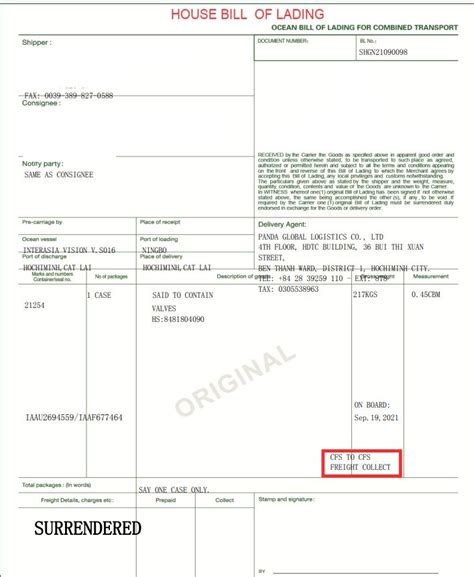

Create a bill of lading (BOL) – When preparing a shipment, fill out a BOL that includes your freight collect account number in the billing section. The BOL should also specify any special instructions, reference numbers, or accessorial services required.

-

Provide BOL copies – Give a copy of the BOL to the carrier’s driver when the shipment is picked up. Retain a copy for your own records and send a copy to the consignee to notify them of the incoming shipment.

-

Track the shipment – Use the carrier’s online tools or mobile app to track your shipment’s progress and estimated delivery date. Promptly notify the carrier of any exceptions or delivery issues.

-

Review invoice and charges – The carrier will send you a detailed invoice, usually on a weekly or monthly basis, listing all shipments and associated charges for the billing period. Carefully review the invoice for accuracy and dispute any discrepancies with the carrier.

-

Make payment – Pay the invoice according to the terms established in your freight collect account agreement. Most carriers offer multiple payment options, such as check, ACH transfer, or credit card.

-

Analyze reports – Regularly review the reports provided by the carrier to gain insights into your shipping patterns, costs, and service levels. Use this data to identify trends, anomalies, and opportunities for improvement.

Sample Bill of Lading

A properly completed BOL is critical to ensure accurate billing and timely delivery of your shipment. Here’s an example of what a typical BOL might look like:

| Shipper | Consignee | Bill To |

|---|---|---|

| ABC Company 123 Main St Anytown, US 12345 |

XYZ Corporation 456 Oak Rd Somewhere, US 67890 |

Freight Collect Account #123456 ABC Company 789 Elm St Anytown, US 12345 |

| Qty | Description | Weight | Class |

|---|---|---|---|

| 2 | Pallets | 1,500 lbs | 70 |

| 1 | Crate | 750 lbs | 92.5 |

Special Instructions: Deliver by 5pm on 6/30. Call 555-1234 for appointment.

Tips for Managing Your Freight Collect Account

To maximize the benefits and minimize the risks of using a freight collect account, follow these best practices:

-

Establish clear internal controls – Implement policies and procedures for creating BOLs, disputing charges, and authorizing payments to prevent errors and fraud.

-

Monitor carrier performance – Regularly assess your carrier’s service levels, on-time delivery rates, claims ratios, and billing accuracy. Address any issues promptly and escalate if needed.

-

Negotiate rates and terms – As your shipping volumes grow, work with your carrier to obtain more favorable rates and payment terms. Consider issuing a request for proposal (RFP) to compare offers from multiple carriers.

-

Automate processes – Utilize electronic data interchange (EDI), application programming interfaces (APIs), or other integration methods to automate the exchange of shipping documents and data with your carrier and internal systems.

-

Allocate costs accurately – Ensure that freight costs are being properly allocated to the correct department, product line, or customer for precise profitability analysis and pricing decisions.

Common Challenges and Solutions

While freight collect accounts offer numerous benefits, they also come with some potential challenges. Here are a few common issues and how to address them:

Incorrect Billing

Challenge: Invoices contain errors or discrepancies, leading to overcharges or disputes.

Solution: Carefully review each invoice and promptly notify the carrier of any mistakes. Implement a formal dispute resolution process and maintain detailed documentation to support your claims.

Late Payments

Challenge: Payments are not made on time, resulting in credit holds, service disruptions, or late fees.

Solution: Set up automated payment reminders and processes to ensure timely payment of invoices. Regularly monitor your account status and proactively communicate with the carrier if there are any issues.

Lack of Visibility

Challenge: Limited access to real-time shipping data and reporting hinders informed decision-making.

Solution: Work with your carrier to implement robust reporting capabilities and data integration. Use business intelligence tools to analyze trends, identify anomalies, and generate actionable insights.

Carrier Performance Issues

Challenge: Poor service levels, frequent damages or delays, or unresponsive customer support.

Solution: Track key performance indicators (KPIs) such as on-time delivery rates, claims ratios, and customer satisfaction scores. Escalate recurring issues to senior management and consider switching carriers if problems persist.

Freight Collect Account FAQs

- What is the difference between freight collect and prepaid shipping?

With freight collect, the charges are billed to a separate account and paid after delivery. With prepaid shipping, the shipper pays the carrier at the time of shipping.

- Can I use my freight collect account with multiple carriers?

No, freight collect accounts are carrier-specific. You will need to set up separate accounts with each carrier you use.

- How long does it take to set up a freight collect account?

The setup time varies by carrier but typically ranges from a few days to a couple of weeks, depending on the credit review process.

- What happens if I dispute a charge on my freight collect account?

The carrier will investigate the disputed charge and make any necessary adjustments. You may be required to provide supporting documentation, such as a BOL or proof of delivery.

- Can I set up different payment terms for different shipments on my freight collect account?

No, the payment terms are established at the account level and apply to all shipments billed to that account. If you need different terms for certain shipments, you may need to set up multiple accounts or use an alternative billing method.

Conclusion

A freight collect account can be a powerful tool for streamlining your shipping operations, reducing costs, and gaining greater control over your transportation spend. By following the steps outlined in this guide, you can successfully set up and manage your own freight collect account to unlock these benefits for your business. Remember to choose the right carrier partner, establish clear internal controls, monitor performance closely, and continuously seek opportunities for optimization. With the right approach, a freight collect account can be a valuable asset in your supply chain management strategy.

Leave a Reply