What is PayPal?

PayPal is an online payment system that allows you to send and receive money electronically. It was founded in 1998 and has since grown to become one of the most trusted and widely used payment platforms in the world. PayPal is used by millions of individuals and businesses to make and receive payments for goods and services, as well as to send money to friends and family.

Benefits of using PayPal

There are many benefits to using PayPal for online payments, including:

Security

PayPal uses advanced security measures to protect your financial information and prevent fraud. When you make a payment through PayPal, your financial information is not shared with the merchant, which reduces the risk of fraud and identity theft.

Convenience

PayPal allows you to make payments quickly and easily from anywhere in the world. You can use PayPal to pay for goods and services online, as well as to send money to friends and family.

Widely accepted

PayPal is accepted by millions of merchants worldwide, making it a convenient option for online shopping and payments.

Buyer protection

PayPal offers buyer protection for eligible purchases, which means that if you do not receive the item you purchased or if it is significantly different from what was described, you may be eligible for a refund.

How to set up a PayPal account

To use PayPal for online payments, you will need to set up a PayPal account. Here’s how:

-

Go to the PayPal website (www.paypal.com) and click on the “Sign Up” button.

-

Choose whether you want to create a personal or business account.

-

Enter your email address and create a strong password.

-

Fill in your personal information, including your name, address, and phone number.

-

Link your bank account or credit card to your PayPal account. This will allow you to add funds to your PayPal balance and make payments.

-

Verify your email address by clicking on the link sent to your email.

-

Your PayPal account is now set up and ready to use.

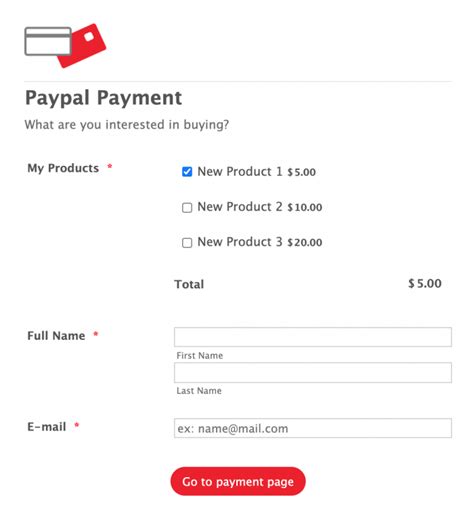

How to make a payment using PayPal

Once you have set up your PayPal account, making a payment is easy. Here’s how:

-

Log in to your PayPal account.

-

Click on the “Send & Request” button at the top of the page.

-

Enter the email address or phone number of the person or business you want to pay.

-

Enter the amount you want to pay.

-

Choose the payment method (PayPal balance, bank account, or credit card).

-

Review the payment details and click “Send Money”.

-

The recipient will receive a notification that they have received a payment from you.

PayPal fees

While PayPal is generally a cost-effective way to make and receive payments online, there are some fees associated with using the platform. Here’s a breakdown of the most common PayPal fees:

| Fee Type | Fee Amount |

|---|---|

| Sending money to friends and family (from PayPal balance or linked bank account) | Free |

| Sending money to friends and family (from credit card) | 2.9% + $0.30 |

| Receiving money for goods or services | 2.9% + $0.30 |

| Withdrawing funds to a bank account | Free |

| Withdrawing funds to a debit or credit card | 1% (up to a maximum of $10) |

It’s important to note that these fees may vary depending on your country and the type of transaction you are making. Be sure to check the PayPal website for the most up-to-date fee information.

PayPal Seller Protection

In addition to Buyer Protection, PayPal also offers Seller Protection for eligible transactions. PayPal Seller Protection can help protect you from chargebacks, reversals, and claims related to unauthorized transactions and items not received.

To be eligible for PayPal Seller Protection, you must meet the following requirements:

- The transaction must be marked as eligible or partially eligible for Seller Protection on your Transaction Details page.

- You must ship the item to the shipping address on the Transaction Details page.

- You must respond to PayPal’s requests for documentation and other information in a timely manner.

- The item must be a physical, tangible good that can be shipped.

If you meet these requirements and a buyer files a chargeback, reversal, or claim against you, PayPal will cover you for the full amount of the eligible transaction, including shipping costs.

PayPal Credit

PayPal Credit is a line of credit that allows you to pay for purchases over time. It is similar to a credit card, but it is offered through PayPal instead of a traditional bank.

To apply for PayPal Credit, you must be at least 18 years old and have a PayPal account in good standing. You will also need to provide some personal and financial information, such as your income and employment status.

Once you are approved for PayPal Credit, you can use it to make purchases at any merchant that accepts PayPal. You will have the option to pay for your purchase in full or to pay over time with PayPal Credit.

PayPal Credit offers a few benefits, including:

- No annual fee

- Flexible payment options

- Special financing offers on select purchases

However, it’s important to note that PayPal Credit does come with interest charges if you choose to pay over time. The interest rate will depend on your creditworthiness and the terms of the financing offer.

PayPal for Business

PayPal is not just for individual buyers and sellers – it also offers a range of tools and services for businesses of all sizes. PayPal for Business allows businesses to accept payments online, send invoices, and manage their finances all in one place.

Some of the key features of PayPal for Business include:

- Accept payments from customers around the world

- Send invoices and request payments

- Set up recurring payments for subscriptions or memberships

- Integrate with popular e-commerce platforms and websites

- Access detailed transaction reports and analytics

PayPal for Business also offers additional security features, such as fraud prevention tools and the ability to set up multi-user access with different permission levels.

To get started with PayPal for Business, you will need to create a PayPal Business account and link it to your business bank account. From there, you can start accepting payments and managing your business finances through PayPal.

Frequently Asked Questions (FAQ)

-

Is it safe to use PayPal for online payments?

Yes, PayPal is a secure and reliable way to make online payments. PayPal uses advanced security measures to protect your financial information and prevent fraud. -

Can I use PayPal to send money to someone in another country?

Yes, you can use PayPal to send money to individuals and businesses in more than 200 countries and regions around the world. -

What should I do if I have a problem with a PayPal transaction?

If you have a problem with a PayPal transaction, you should first try to resolve the issue with the seller or recipient directly. If you are unable to resolve the issue, you can file a dispute with PayPal. PayPal will investigate the issue and work to resolve it in accordance with their policies. -

How do I add funds to my PayPal account?

You can add funds to your PayPal account by linking a bank account or credit card, or by receiving payments from other PayPal users. You can also add funds by making a direct deposit or by transferring money from another online payment platform. -

Can I withdraw money from my PayPal account?

Yes, you can withdraw money from your PayPal account to your linked bank account or debit card. PayPal does not charge a fee for withdrawing funds to a bank account, but there may be a small fee for withdrawing to a debit card.

Conclusion

PayPal is a secure, convenient, and widely accepted way to make and receive payments online. Whether you are an individual looking to shop online or send money to friends and family, or a business looking to accept payments and manage your finances, PayPal has a range of tools and services to meet your needs.

By following the steps outlined in this article, you can easily set up a PayPal account, make payments, and take advantage of the many benefits that PayPal has to offer. And if you ever have any questions or concerns, PayPal’s customer support team is always available to help.

Leave a Reply