Overview of the EMS Market

Electronic Manufacturing Services (EMS) refers to the outsourcing of electronic product manufacturing to specialized companies. These companies provide a range of services, including design, assembly, testing, and supply chain management. The EMS industry has grown significantly over the past few decades, driven by the increasing complexity of electronic devices and the need for cost-effective manufacturing solutions.

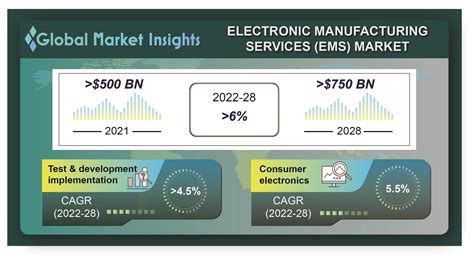

Market Size and Growth

The global EMS market was valued at USD 463.2 billion in 2020 and is expected to reach USD 796.5 billion by 2024, growing at a CAGR of 11.5% during the forecast period (2021-2024). This growth can be attributed to several factors, including:

- Increasing demand for consumer electronics

- Growing adoption of IoT devices

- Rising need for advanced manufacturing capabilities

- Expansion of the automotive and healthcare sectors

| Year | Market Size (USD Billion) | Growth Rate (%) |

|---|---|---|

| 2020 | 463.2 | – |

| 2021 | 516.7 | 11.5 |

| 2022 | 576.1 | 11.5 |

| 2023 | 642.5 | 11.5 |

| 2024 | 796.5 | 11.5 |

Key Players in the EMS Market

The EMS market is highly competitive, with several major players dominating the industry. These companies offer a wide range of services and have established themselves as trusted partners for original equipment manufacturers (OEMs) across various sectors. Some of the key players in the EMS market include:

- Foxconn (Hon Hai Precision Industry Co., Ltd.)

- Pegatron Corporation

- Flex Ltd.

- Jabil Inc.

- Sanmina Corporation

- Celestica Inc.

- Benchmark Electronics, Inc.

- Plexus Corp.

- Venture Corporation Limited

- Kimball Electronics, Inc.

Market Share of Key Players

| Company | Market Share (%) |

|---|---|

| Foxconn | 23.5 |

| Pegatron | 12.7 |

| Flex | 9.2 |

| Jabil | 7.8 |

| Sanmina | 4.5 |

| Others | 42.3 |

Trends Shaping the EMS Market

The EMS market is influenced by several key trends that are driving innovation and shaping the future of the industry. These trends include:

1. Industry 4.0 and Smart Manufacturing

Industry 4.0, also known as the Fourth Industrial Revolution, is transforming the manufacturing landscape by integrating advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and robotics into production processes. EMS providers are adopting these technologies to enhance efficiency, reduce costs, and improve product quality.

2. Miniaturization and High-Density Packaging

As electronic devices become smaller and more complex, EMS companies are focusing on miniaturization and high-density packaging techniques. This trend requires advanced manufacturing capabilities, such as 3D printing, micro-molding, and innovative material solutions, to meet the demanding requirements of modern electronic products.

3. Sustainable and Eco-Friendly Manufacturing

With growing concerns over environmental sustainability, EMS providers are increasingly adopting eco-friendly manufacturing practices. This includes the use of renewable energy sources, the implementation of waste reduction strategies, and the development of recyclable and biodegradable materials.

4. Supply Chain Optimization and Resilience

The COVID-19 pandemic has highlighted the importance of a resilient and agile supply chain. EMS companies are focusing on optimizing their supply chain networks, diversifying their supplier base, and leveraging advanced technologies such as blockchain and AI to improve visibility and mitigate risks.

Market Segmentation

The EMS market can be segmented based on various factors, including service type, end-user industry, and geography.

Service Type

- Electronic Design & Engineering

- Electronics Assembly

- Electronic Manufacturing

- Supply Chain Management

- Others

| Service Type | Market Share (%) |

|---|---|

| Electronic Design & Engineering | 22.5 |

| Electronics Assembly | 35.8 |

| Electronic Manufacturing | 28.2 |

| Supply Chain Management | 9.4 |

| Others | 4.1 |

End-User Industry

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

- Healthcare

- Telecom & Networking

- Others

| End-User Industry | Market Share (%) |

|---|---|

| Consumer Electronics | 34.2 |

| Automotive | 18.7 |

| Industrial | 15.5 |

| Aerospace & Defense | 9.8 |

| Healthcare | 7.3 |

| Telecom & Networking | 6.9 |

| Others | 7.6 |

Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

| Region | Market Share (%) |

|---|---|

| North America | 28.5 |

| Europe | 23.2 |

| Asia Pacific | 41.6 |

| Latin America | 4.1 |

| Middle East & Africa | 2.6 |

Future Outlook and Projections

The EMS market is expected to experience significant growth in the coming years, driven by the increasing demand for electronic products and the adoption of advanced manufacturing technologies. Key factors that will shape the future of the EMS industry include:

- Continued growth in the consumer electronics, automotive, and healthcare sectors

- Rapid advancements in AI, IoT, and 5G technologies

- Increasing focus on sustainability and eco-friendly manufacturing practices

- Expansion of EMS providers into emerging markets

Projected Market Size and Growth

| Year | Market Size (USD Billion) | Growth Rate (%) |

|---|---|---|

| 2025 | 887.4 | 11.4 |

| 2026 | 988.7 | 11.4 |

| 2027 | 1,101.5 | 11.4 |

| 2028 | 1,227.1 | 11.4 |

Challenges and Opportunities

The EMS market faces several challenges and opportunities that will shape its future trajectory:

Challenges

- Intense competition and pricing pressure

- Rapid technological advancements and short product lifecycles

- Supply chain disruptions and geopolitical risks

- Skilled labor shortages and rising labor costs

Opportunities

- Growing demand for advanced manufacturing capabilities

- Expansion into new end-user industries and emerging markets

- Adoption of Industry 4.0 technologies to improve efficiency and competitiveness

- Increased focus on sustainable manufacturing and circular economy principles

FAQ

-

What is the Electronic Manufacturing Services (EMS) market?

The EMS market refers to the outsourcing of electronic product manufacturing to specialized companies that provide services such as design, assembly, testing, and supply chain management. -

What are the key factors driving growth in the EMS market?

Key growth drivers include increasing demand for consumer electronics, growing adoption of IoT devices, rising need for advanced manufacturing capabilities, and expansion of the automotive and healthcare sectors. -

Who are the major players in the EMS market?

Major players in the EMS market include Foxconn, Pegatron, Flex, Jabil, Sanmina, and Celestica, among others. -

What are some of the key trends shaping the EMS industry?

Key trends include the adoption of Industry 4.0 technologies, miniaturization and high-density packaging, sustainable and eco-friendly manufacturing practices, and supply chain optimization and resilience. -

What is the projected market size of the EMS industry by 2024?

The global EMS market is expected to reach USD 796.5 billion by 2024, growing at a CAGR of 11.5% during the forecast period (2021-2024).

Leave a Reply